For approximately thirty years, British Columbia (BC) has had the most affordable sawlog costs in North America. However, starting in 2018, there has been a decrease in timber supply, a decline in log quality, and a significant increase in wood raw-material prices.

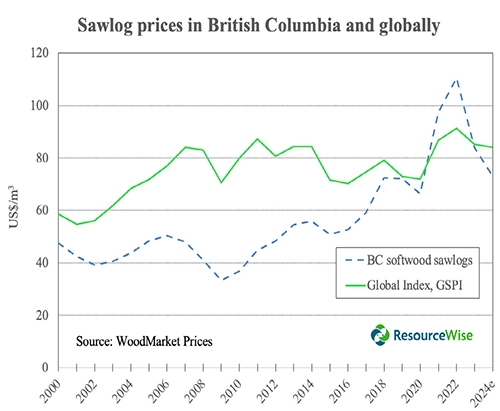

For approximately thirty years, British Columbia (BC) has had the most affordable sawlog costs in North America. However, starting in 2018, there has been a decrease in timber supply, a decline in log quality, and a significant increase in wood raw-material prices. Following the 2009 economic downturn, sawlog prices in the province rose from US$32/m3 to nearly US$120/m3 by 2022, leading the province to transition from being the cheapest to the most expensive region for logs in North America. In contrast, the sawmill sector in the US South expanded its capacity, primarily due to the exceptionally low wood costs experienced in 2023 and 2024.

Since peak prices in BC in early 2022, wood raw material costs have plunged, driven by weaker lumber markets. Most sawmills in the province curtailed production in 2023, and in early 2024, sawlog costs were down by 40% from their 2022 peak, reaching their lowest level in almost four years, according to WoodMarket Prices (ResourceWise).

Although this recent, sharp decline has dropped price levels to nearly their 10-year average due to weak lumber demand in the US, lumber manufacturers in this region still have some of the highest wood costs in North America.

For most of the past 25 years, sawlog prices in BC have been lower than the Global Sawlog Price Index (GSPI). The index, consisting of sawlog prices from 21 key regions worldwide, has trended upward for the past five years, mainly driven by higher prices in Europe, British Columbia, and Brazil. The slowing demand for lumber worldwide in the past year has resulted in lower sawlog prices in BC and other regions of North America, Eastern Europe, Central Europe, and Russia. However, BC sawlog prices have declined more than most countries in the past year and were again lower than the GSPI in 2024, as seen in the chart below.

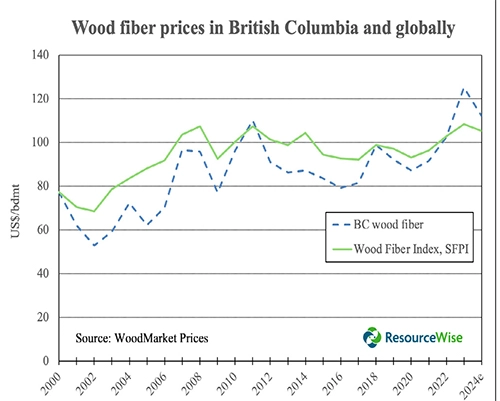

Wood fiber costs for the BC pulp industry have followed a similar trend as sawlog costs described above. They were lower than the global Softwood Fiber Price Index (SFPI) for most of the past 25 years and, as with sawlogs, saw a rapid surge to surpass the SFPI from 2019 to 2022. This surge was followed by a period of declining prices, as seen in the chart below. The most significant difference is that wood fiber prices have not fallen as much in the past year as prices for sawlogs, remaining near their all-time high in early 2024.

The pulp industry in BC has become less competitive in the North American markets, as pulp manufacturers in the US South, US Northwest, and Eastern Canada have enjoyed significantly lower wood fiber costs. Since fiber costs account for 50-75% of production costs, the BC industry is disadvantaged when competing in the commodity markets for pulp and paper.

As high wood costs and a bleak outlook on available timber supply persist, sawmills and pulpmills have been forced to permanently close manufacturing facilities in BC. Given these significant headwinds, forest companies continue to increase investments in regions outside of the province.

Market Insights is a subscription service available in WoodMarket Prices, a global analytics platform from ResourceWise.

WoodMarket Prices is a unique and valuable tool for every organization that requires updates on the latest developments of global forest products markets.

The pricing data service, established in 1988, has subscribers in over 30 countries. WoodMarket Prices tracks prices for sawlog, pulpwood, lumber, and pellets and reports on trade and wood market developments in most key regions worldwide.