Pulp & Paper Industry News and Insights

In The Spotlight

European Union (EU) Commission Proposal on EUDR misses the mark

In an increasingly industrialised and interconnected world, environmental issues are becoming more and more important as the years go by.

Saica Group has strengthened its North American footprint with the inauguration of a new plant in Anderson, Indiana ...

The European Commission unveiled targeted measures to ensure the smooth and timely implementation of the EU Deforestation Regulation (EUDR).

Maine’s draft rule lists molded fiber packaging as recyclable and compostable

Domtar’s Kingsport Mill has received national recognition for its environmental transformation,...

Lecta announced that its Condat paper mill will file for court protection with the Commercial Court in Bordeaux on October 22.

Georgia-Pacific has announced plans to permanently close its Memphis Cellulose mill and the Memphis Technology and Innovation Center.

FV Recycling has acquired Mid America Paper Recycling, one of the largest independent brokers, processors, and exporters of recovered materials in the Central United States.

Feature Articles

Top Stories

Saica Group has strengthened its North American footprint with the inauguration of a new plant in Anderson, Indiana ...

The European Commission unveiled targeted measures to ensure the smooth and timely implementation of the EU Deforestation Regulation (EUDR).

Maine’s draft rule lists molded fiber packaging as recyclable and compostable

Domtar’s Kingsport Mill has received national recognition for its environmental transformation,...

Lecta announced that its Condat paper mill will file for court protection with the Commercial Court in Bordeaux on October 22.

Georgia-Pacific has announced plans to permanently close its Memphis Cellulose mill and the Memphis Technology and Innovation Center.

European Union (EU) Commission Proposal on EUDR misses the mark

Forest sector directly employs 200,000 Canadians (plus another 200,000 indirectly)

I was first introduced to rice paper as a child when my mother baked almond macaroons.

In an increasingly industrialised and interconnected world, environmental issues are becoming more and more important as the years go by.

Additional U.S. tariffs come into effect today on forestry products

Transforming textile waste into paper products: A Quebec innovation at the forefront of the circular economy

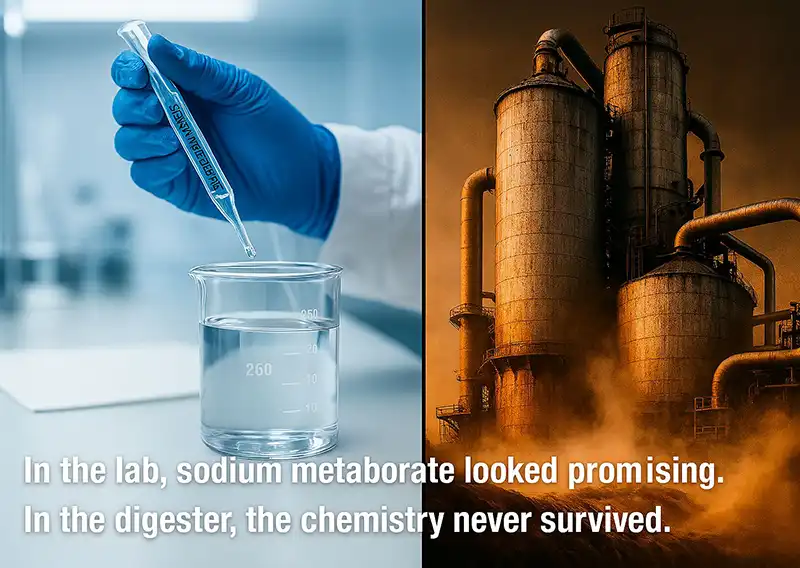

The pulp and paper industry is constantly evolving, driven by the need to optimize processes and uphold high-quality standards.

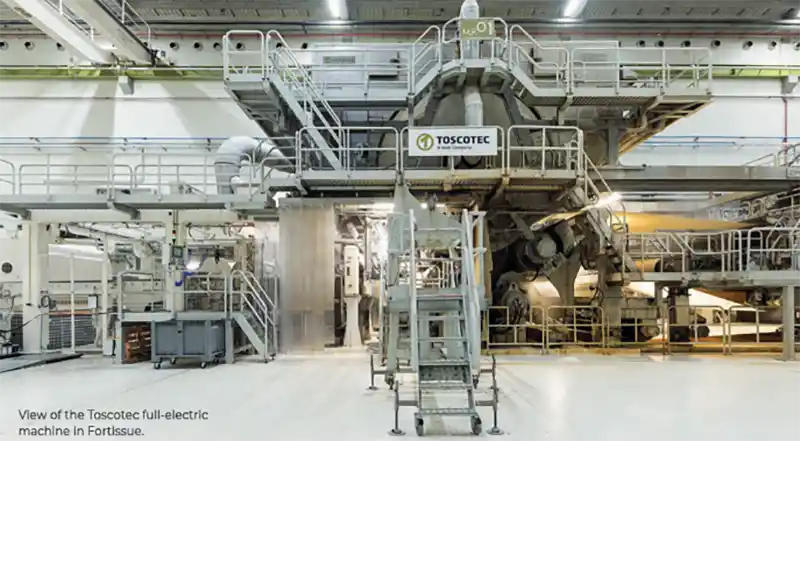

The paper industry, long recognized as an energy-intensive sector, is now at a crucial turning point.

Many tissue mills face the ongoing challenge of sustaining high production standards while navigating workforce changes ...

In a rapidly changing job market, leadership development and a strong understanding of internal operations have become essential.

ABB has introduced ABB Ability™ Plant Optimizer for Pulp Mills, a dynamic software solution ...

In the pulp and paper industry, energy consumption and efficiency are not just buzzwords; they are the linchpins of sustainable and profitable operations.

FBA has announced a leadership transition within its Technical Committee, ...

Ahlstrom has introduced a new flame-retardant paper featuring its proprietary Flame-Gard™ technology, ...

BMI Group has officially completed its purchase of the former Espanola pulp and paper mill, ...

At SPC Advance 2025, sustainable packaging leaders made one thing clear: the industry isn’t waiting for change — it’s driving it.