Lumber trade has become more global over the past few decades with an increased flow of wood products from forest-rich countries to regions lacking domestic forests to supply the local markets.

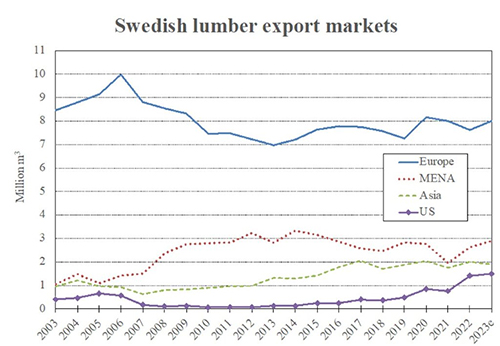

One good example is Sweden, where lumber manufacturers in recent years have expanded their sales far outside the markets they supplied in the past. Fifteen years ago, almost 80% of the country’s lumber export volume was shipped to European markets. That share has declined to about 55% in the past years (see chart).

Sources: Wood Resources International and Customs Data

Sources: Wood Resources International and Customs Data

The biggest decline in market shares has been in the MENA region, which fell from 28% to 20% over the past ten years. During the same period, the US market has increased in importance, with the share rising from about 1% in 2013 to over 9% in 2Q/23. According to Wood Resources International, this has been a positive development for many Swedish sawmills since the prices for lumber destined for the US are substantially higher than for wood sold to countries in Northern Africa and the Middle East. In the 2Q/23, the average export price for the US was almost 45% higher than for lumber exported to Egypt, the largest market in the MENA region.

Sweden exported 10% more lumber in the first half of 2023 than during the same period in 2022, and in 2023 is on track to be a record year in shipments. The biggest increases y-o-y were seen in sales to MENA followed by Europe, while export volumes to the US and Asia fell by 8% and 3%, respectively. The strongest improvements to the top-10 markets this year have been to China (+59% y-o-y), the Netherlands (+49%), Egypt (+36%), France (+17%), and the UK (+15%).

There is much uncertainty in worldwide demand for lumber in the 2H/23. However, there are signals of upward movements in prices in the US market because of tighter supply and slightly higher demand, which could be good news for Swedish lumber exporters. During the first six months of 2023, the US total import volume was just over 17 million m3, the lowest half-year import volume since the 1H/20. Sweden’s share of this market has increased from 1.9% in the 1H/21 to 3.3% in the 1H/23. In 2023, the leading European exporters to the US were Germany (52% of the European supply), Sweden (22%), Austria (7%), Romania (7%), and the Czech Republic (3%). With the log supply tightening in Central Europe, exports from this region will likely decline in the coming year.

Wood Resource Quarterly has been digitized and is now available as an interactive online business intelligence platform, WoodMarket Prices. The pricing data service, established in 1988, has subscribers in over 30 countries. WoodMarket Prices tracks prices for sawlog, pulpwood, lumber, and pellets and reports on trade and wood market developments in most key regions worldwide. For more insights on the WoodMarket Prices platform, a unique and valuable tool for every organization that requires updates on the latest developments of global forest products markets, please visit www.resourcewise.com/platforms/woodmarket-prices.

Contact Information

Wood Resources International LLC, a ResourceWise Company

Hakan Ekstrom, Seattle, USA

Hakan Ekstrom

Hakan Ekstrom

Wood Resources International LLC