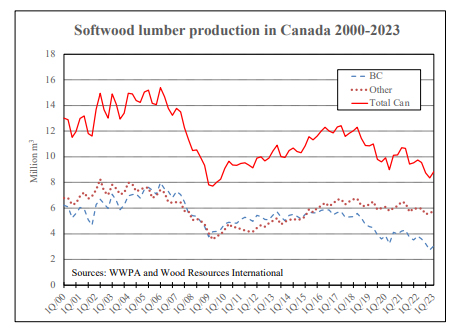

Canada is the world's second-largest producer of softwood lumber, behind the United States. Over the past five years, production has decreased from 48 million m3 in 2017 to 37 million m3 in 2022.

Last year, the country's sawmill output was down almost 40% from the heydays two decades ago when the all-time high reached nearly 60 million m3 .

The history of the Canadian sawmilling industry has developed quite differently in British Columbia compared to the rest of the country. During much of the period from 2000 to 2016, BC production was close to 50% of Canada's total output. Following the pine-beetle infestation in the province, harvest levels declined, and the lumber sector was forced to downsize. While sawmills continued to produce about 25 million m3 annually in the eastern provinces to supply the strong US market, production in the west coast province fell from 23 million m3 in 2016 to only 13 million m3 in 2022 (see chart). This downward trend continued in the 1Q/23 when lumber shipments were down 20% y-o-y, while they held steady in the rest of the country.

The outlook for tighter lumber supply in North America could strengthen lumber prices in the US in the second half of 2023 and create opportunities to ramp up sawmill production levels somewhat, particularly in British Columbia. However, there may be constraints in the availability of sawlogs because of limitations in accessing the provincial forests during the fire season. The US relies on about 30% of imported lumber to meet the country's wood consumption. Historically, Canadian sawmills have supplied 90-97% of the import volume, but in recent years the flow from Canada has declined because of the reduced production in British Columbia. On the other hand, European sawmills have increased their market shares to about 15% in 2023, up from just a few percent five years ago. With limited opportunities for Canada to increase lumber production, European sawmills will likely remain essential suppliers for the US wood market in the coming decade.

Wood Resource Quarterly has been digitized and is now available as an interactive online business intelligence platform, WoodMarket Prices. The pricing data service, established in 1988, has subscribers in over 30 countries. The WMP tracks prices for sawlog, pulpwood, lumber & pellets and reports on trade and wood market developments in most key regions worldwide. For more insights on the WMP platform, a unique and valuable tool for every company and organisation that require updates on the latest developments of global forest products markets, please go to Global Wood Prices

Contact Information

Wood Resources International LLC, a ResourceWise Company

Hakan Ekstrom, Seattle, USA

Hakan Ekstrom

Hakan Ekstrom

Wood Resources International LLC