The creation of the newly formed dynamic packaging company Smurfit WestRock has left many pulp and paper professionals wondering how this merger will impact them. In our previous blog posts, we explored the potential impacts suppliers and competitors could face.

Now, in our third and final installment of the series, we’re focusing on what purchasers of paper packaging should consider in light of this merger.

First, it’s important to note that with this merger, Smurfit WestRock will have an extensive network of over 350 pulp and papermaking mills and converting sites across three different continents. This expansion could give purchasers access to more manufacturing sites under one unified company which has the potential to improve product options/availability and shorten the supply chain. Additionally, this could result in reduced carbon emissions associated with transportation from the manufacturing sites to converting facilities.

Figure 1: Smurfit WestRock Pulp and Paper Mills and Converting Sites

Source: FisherSolve

Source: FisherSolve

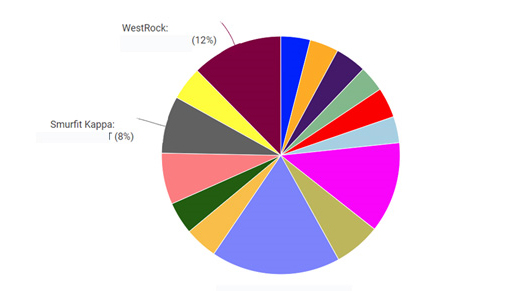

The combination of Smurfit Kappa and WestRock will also result in an expected annual capacity of nearly 23 million short tons. This will make them the largest global producer of packaging paper with approximately 20% market share.

Figure 2: Global Paper Packaging Producers

Source: FisherSolve

Source: FisherSolve

With Smurfit WestRock now holding such a significant portion of the packaging market, buyers may be wondering how this will impact pricing. The merger means buyers will now be negotiating with a single company, which can actually bring some advantages considering its large market share, such as:

- Streamlined Processes: When companies merge, one of their main goals is to streamline their operations, aiming for a more efficient and cost-effective process. This not only benefits the merged company but also brings efficiency to the purchasers’ business operations.

- Economies of Scale: When two companies merge and form a larger entity with a significant market share, they can often enjoy the advantages of economies of scale. This can result in lower production costs, which in turn can lead to more competitive pricing for their products. Streamlining their operations and taking advantage of their increased size, the merged company can offer better value to their customers.

- Reduction of Carbon Emissions: With the ability to streamline their processes, Smurfit WestRock has a unique opportunity to significantly reduce carbon emissions. This reduction will be particularly high in areas related to transportation

However, as with most things, where there are advantages, there also come disadvantages. Purchasing from a large newly merged company may bring about certain potential drawbacks.

For example, merging two companies can often bring about a series of integration challenges, which can then lead to disruptions in various aspects of the business, including supply chains, customer service, and even product quality.

Given certain potential challenges, purchasers may want to consider alternative purchasing methods. One such option is a cost-plus hedge index, which guarantees a fixed producer’s margin.

Benefits that could come with choosing this method include reduced volatility as compared to a market-based price adjustment mechanism and increased transparency. The cost benchmarking module in FisherSolve can be utilized to determine the fundamental manufacturing cost and the granular input pricing that drives it. Several large CPG (Consumer Packaged Goods) companies already rely on FisherSolve to prepare for purchasing negotiations and for contract pricing adjustments.

When it comes to deciding whether to purchase from a large newly merged company or explore alternative procurement methods, companies must carefully consider their individual circumstances. Factors such as risk tolerance, performance expectations, and strategic objectives play a crucial role in determining the most suitable approach.

At ResourceWise, our suite of analytical tools empowers businesses to anticipate future pricing changes and plan for potential impact on their supply chains. Our comprehensive tools encompass key factors such as inventory levels, operating rates, and supply/demand dynamics.

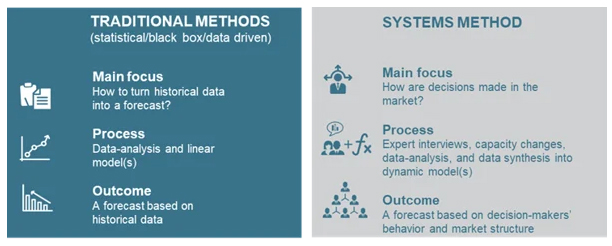

Utilizing an advanced systems approach, we can provide insightful forecasts that account for market dynamics including buying/selling drivers and changes in capacity. With this valuable information, businesses can make informed decisions and navigate the ever-changing market landscape with confidence.

Figure 3: Fisher STE Forecasting Method

ResourceWise’s comprehensive data analytics platforms, strategic consulting services, and sophisticated forecasting reports can help you gain a profound understanding of market trends, drivers, and business impacts. Best of all, they can be specifically tailored to your unique business needs.

Source: ResourceWise