As late as 2019, China imported almost 100 million m3 rwe (roundwood equivalents) of softwood logs and lumber to meet the growing demand for forest products in the domestic market.

Since then, wood consumption has declined, and the importation of forest products has decreased to levels not seen in over a decade. Wood Resources International reports that China imported about 12 million m3 of logs and lumber (rwe) in the 1Q/23, nearly half its peak in the 3Q/20 and the second lowest quarterly imports in ten years.

According to the World Bank, China’s economy took a big hit during the Covid epidemic, with the GDP growth falling to an estimated three percent in 2022, compared to a nine percent average annual increase from 1978-2021. It is estimated that the economy will see a rebound to just over five percent growth in 2023.

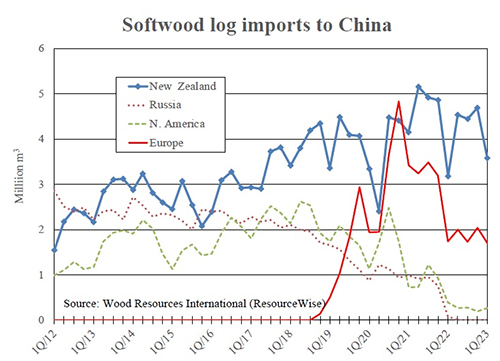

China’s dramatic reduction in log imports has predominantly been driven by the lack of supply from Russia following the country’s implementation of a log export ban in January 2022. Russia was the largest log supplier to China until 2012 when New Zealand surpassed it. Since then, Russia’s shipments have fallen consistently and were down to zero in 2022. With log supply from Russia, Australia, Canada, and the US plunging over the past five years, New Zealand and Europe have become the two major regions supplying China (see chart).

During the first four months of 2023, New Zealand’s market share of China’s total log imports was 58%, followed by Germany (14%), Poland (5%), the US (5%), Canada (4%), and Japan (4%). The outlook is for declining shipments from North America and Europe, eventually leaving New Zealand as the only remaining major log supplier. Consequently, China will need to explore opportunities to increase lumber imports rather than logs to meet future wood demand.

Wood Resource Quarterly has been digitized and is now available as an interactive online business intelligence platform, WoodMarket Prices. The pricing data service, established in 1988, has subscribers in over 30 countries. The WMP tracks prices for sawlog, pulpwood, lumber & pellets and reports on trade and wood market developments in most key regions worldwide. For more insights on the WMP platform, a unique and valuable tool for every company and organisation that require updates on the latest developments of global forest products markets, please go to Global Wood Prices

Contact Information

Wood Resources International LLC, a ResourceWise Company

Hakan Ekstrom, Seattle, USA

Hakan Ekstrom

Hakan Ekstrom

Wood Resources International LLC