Increased interest rates, higher inflation, and market uncertainty regarding a possible recession in 2023 resulted in reduced housing starts and decreased renovations in the second half of 2022.

These two wood end-use sectors are significant drivers in the consumption of forest products demand worldwide and often set consumption and pricing levels of sawlogs in many markets. The weak lumber markets have led to reduced sawlog prices, with some delay, on most continents. The most significant price declines from the 1H/22 to the 2H/22 (in local currencies) occurred in Western North America, Baltic States, and Central Europe., according to the WoodMarket Prices.

With the US dollar strengthening against most currencies worldwide during 2022, sawlog prices in US dollar terms were down between 3-20% in most of Europe and Asia from the 4Q/21 to the 4Q/22. In North America, prices moved down in the second half of 2022, but they were still up a few percentage points y-o-y in the 4Q/22.

The Global Sawlog Price Index (GSPI), consisting of sawlog prices from 21 key regions worldwide, has fallen for two consecutive quarters from its all-time high of US$94.96/m3 in the 2Q/22 to US$87.50/m3 in the 4Q/22, an eight percent decline. The recent decline of the GSPI follows a two-year period of increases. From the 2Q/20 to the 2Q/22, the Index rose almost 30%.

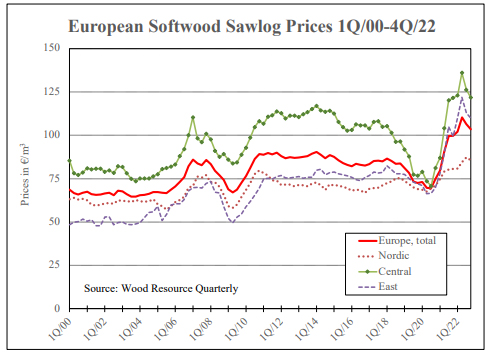

The Euro-denominated European Sawlog Price Index (ESPI) also fell in late 2022 to €103.63/m3 after reaching a record high of €110.40/m3 in the 2Q/22. Despite the six percent decline in six months, current sawlog prices are still close to their highest levels in over 20 years. Over the past five years, log prices in Europe have undergone dramatic swings, with the ESPI falling from €85/m3 in 2018 to a 15-year low of €72/ m3 in 2020, followed by an all-time high of €106/ m3 in 2022 (see chart). The price discrepancies between the Nordic, Central, and Eastern regions have also changed since 2020, when there was only an €8/m3 difference between the low-cost Nordic and high-cost Central regions. This discrepancy increased to €42/m3 in 2022 because of relatively modest price changes in Northern Europe, while log costs surged in continental Europe.

Wood Resource Quarterly has been digitized and is now available as an interactive online business intelligence platform, WoodMarket Prices. The pricing data service, established in 1988, has subscribers in over 30 countries. The WMP tracks prices for sawlog, pulpwood, lumber & pellets and reports on trade and wood market developments in most key regions worldwide. For more insights on the WMP platform, a unique and valuable tool for every company and organisation that require updates on the latest developments of global forest products markets, please go to Global Wood Prices

Contact Information

Wood Resources International LLC, a ResourceWise Company

Hakan Ekstrom, Seattle, USA

Hakan Ekstrom

Hakan Ekstrom

Wood Resources International LLC