The announced merger between Smurfit Kappa and WestRock has been making waves across the pulp and paper industry.

The creation of such a dynamic packaging company with an expanded global reach, increased production capacity, and a strong focus on innovation and sustainability has many stakeholders considering the impacts it could create.

In part one of our blog series, we explored how this merger would impact the suppliers of these two companies. In the second part of our three-part series, we will delve into potential risks and opportunities that competitors may face as a result of this merger.

Potential Risks

Expanded Reach

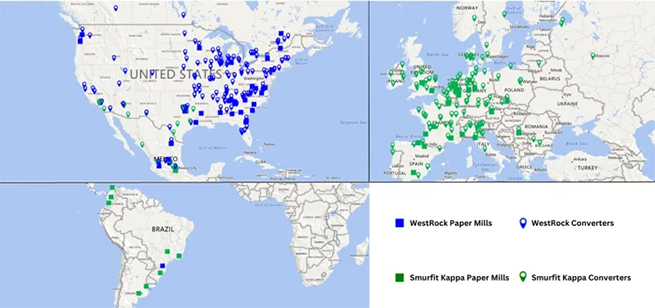

The merger between Smurfit Kappa and WestRock brings with it an expanded geographic reach for Smurfit WestRock. This enables them to effectively serve customers with operations in both the Americas and Europe.

The question that arises is whether customers will seek an alternative source of supply or consolidate their packaging purchases from Smurfit WestRock. Either way, this decision by customers could present both opportunities and risks for competitors in the industry.

Some customers may prefer the convenience and efficiency of a single supplier that can cater to their needs across different regions. The potential consolidation could create an opportunity for Smurfit WestRock to secure new customers and grow its market share. This however would then present a risk for competitors who may lose business if customers opt for the convenience of a one-stop packaging supplier.

With its expanded customer base, Smurfit WestRock will have the opportunity to focus on cross-selling. The company would offer a comprehensive range of packaging solutions, from corrugated boxes to cartonboard to innovative eco-friendly alternatives. This means they could leverage their expanded product portfolio to cross-sell to their existing customer base.

This cross-selling strategy allows the company to meet all packaging needs, strengthen relationships with existing customers, and attract new customers seeking a comprehensive packaging solution. To mitigate this risk, competitors must find ways to differentiate themselves in the market. They need to emphasize their unique selling points, whether it be their specialization in a particular type of packaging, their commitment to sustainability, or their ability to provide customized solutions.

Operational Cost Savings

Smurfit WestRock intends to achieve operational efficiencies through the merger. If executed effectively, this could result in cost reductions and operational streamlining. Bypassing these savings onto their customers via lower prices, Smurfit WestRock would pose a risk to their competitors as cost savings are a significant factor that customers must consider.

However, it’s possible that the integration of two large organizations, encompassing people, operations, and the pursuit of promised synergies, could divert their attention from the market and customer needs. If this distraction occurs, competitors may have an opportunity to gain an advantage by focusing on and responding to customer and market needs.

Accelerated Innovation and Advancements in Sustainable Packaging

Both Smurfit Kappa and WestRock have strong innovation capabilities and sustainability goals. The combined company will aim to accelerate its ability to launch new packaging products. With sustainability initiatives on the rise, even more companies are looking for innovative and eco-friendly ways to package or ship their goods, and many are opting for paper packaging.

Smurfit WestRock, with its increased production capacity and focus on innovation, has the potential to streamline the development and introduction of new packaging solutions that align with sustainability goals.

This would undoubtedly pose a risk for competitors. They would need to respond by investing in research and development to launch their own eco-friendly packaging alternatives or find other ways to differentiate themselves in the market.

Opportunities

How Competitors Can Stay Ahead

The combination of Smurfit Kappa and WestRock comes at a time of relatively low-capacity utilization in the containerboard industry. ResourceWise has industry models that can explain and predict how the merger will impact industry supply, demand, and margins.

ResourceWise's Fisher-STE Market Models

Our market models use a robust combination of reliable data, industry expertise, and advanced System Dynamics mathematical models. What sets our models apart is their ability to simulate and analyze the fundamental drivers of markets and their intricate interactions. This includes comprehensive insights into supply and demand dynamics, pricing trends, inventory management, and much more.

Viability Benchmarking Module

As Smurfit WestRock continues to optimize its mill network and capacity, FisherSolve's Viability Benchmarking Module (pictured below) allows for the proactive anticipation of potential future mill closures. By leveraging this powerful tool, users can accurately predict the long-term viability of pulp lines and paper machines. Competitors can assess which mills making the same grades are likely to survive or close.

FisherSolve's Viability Benchmarking Module

FisherSolve's Viability Benchmarking Module

In a rapidly evolving industry, staying ahead of the competition requires access to reliable and accurate data. By utilizing FisherSolve's data and models, you can gain a deep understanding of market dynamics, assets, and current and future capacity. This knowledge will help you to proactively prepare for potential market changes. Contact us today to discover how FisherSolve's comprehensive data solutions can empower your business.

Learn more about FisherSolve's Viability Benchmarking Module.

Source: ResourceWise