Technology is important but global concerns play an increasingly important role

Pulp and Beyond, the successor to Finland’s PulPaper conference, made a number of significant changes to the event in 2024 to renew interest among delegates and exhibitors.

First, the dates were moved to early April from its traditional early June spot. This was done, said Antti Lindquist, PI (Finnish Forest Products Engineers Association), to attract more students as June is their exam period. Also, it gives suppliers more time to pursue leads before the Midsummer holiday as well summer holidays which usually last the month of July.

Exhibitor booths were restricted to a maximum 40 m2 and the lay-out of the hall was more an “open” concept, not the traditional grid system. The exhibit itself was open for two days (Wednesday-Thursday).

Linquist said once the principles were explained, the suppliers got on board. The changes have proved successful enough that organizers are planning the next Pulp and Beyond for Apil 15-16, 2026.

As with PulPaper in 2022, a press tour was organized. The trip was sponsored by the Expo Foundation in Finland. Besides attending the conference, editors also met with various suppliers, associations and producers. Later in the week, they visited the Metsä biorefinery in Äänekoski as well as tours of VTT and Suzano/Spinnova in Jyväskylä.

The opening day was devoted to the conference and more than 300 people filled three halls to hear a series of papers divided into three themes; innovative wood-based products; carbon-zero future mills; and, the 2024 International Control Systems Conference. Before that, three keynote talks opened the day’s events.

Michael CarusMichael Carus, founder and CEO of nova-Institute, and executive director of the Renewable Carbon Initiative, spoke about the role of wood in the renewable carbon concept. There will be a lasting need for carbon in chemistry and materials. Therefore, to cover the demand for carbon, it must come from alternative sources; a key one will be biomass, carbon dioxide and recycling carbon-containing waste streams.

Michael CarusMichael Carus, founder and CEO of nova-Institute, and executive director of the Renewable Carbon Initiative, spoke about the role of wood in the renewable carbon concept. There will be a lasting need for carbon in chemistry and materials. Therefore, to cover the demand for carbon, it must come from alternative sources; a key one will be biomass, carbon dioxide and recycling carbon-containing waste streams.

So, Carus said, it is not decarbonization, but recarbonization. By 2050, carbon demand could reach 1.15 million tonnes. But, Carus said this could come from bio-based materials (20%), CO2- based (25%), recycling (bio-based, recyclate co2-based. 50%); and, recycling (fossil-based, 5%).

Lignocellulosic biorefineries could play a key role in the production of: fuels, especially sustainable aviation fuel; a wide range of chemicals and polymers; replacing food crop-based biorefineries; as well as wood pulp for cellulose fibers.

Tiina PursulaThe second keynote came from Tiina Pursula, Stora Enso, who discussed the company’s three growth areas: renewable packaging, sustainable building solutions and biomaterial innovation. The global megatrends that underly Stora Enso’s business strategy are circularity, eco-awareness, climate change and resource scarcity.

Tiina PursulaThe second keynote came from Tiina Pursula, Stora Enso, who discussed the company’s three growth areas: renewable packaging, sustainable building solutions and biomaterial innovation. The global megatrends that underly Stora Enso’s business strategy are circularity, eco-awareness, climate change and resource scarcity.

Katja KeitaanniemiKatja Keitaanniemi, CEO, OP Corporate Bank, closed out the opening session by noting that although the forest products industry is prone to protection measures passed by regulatory bodies because of its role as a carbon sink, its raw material is relatively resistant to climate change.

Katja KeitaanniemiKatja Keitaanniemi, CEO, OP Corporate Bank, closed out the opening session by noting that although the forest products industry is prone to protection measures passed by regulatory bodies because of its role as a carbon sink, its raw material is relatively resistant to climate change.

Olli Ylä-JarkkoThe three theme sessions were held concurrently. Looking at innovative wood-based products, Olli Ylä-Jarkko, CTO, TreetoTextile, said there is a need for more sustainable and bio-based fibers. Based in Sweden, TreeToTextile has developed a new fiber that can be used in textile or non-woven applications.

Olli Ylä-JarkkoThe three theme sessions were held concurrently. Looking at innovative wood-based products, Olli Ylä-Jarkko, CTO, TreetoTextile, said there is a need for more sustainable and bio-based fibers. Based in Sweden, TreeToTextile has developed a new fiber that can be used in textile or non-woven applications.

Founded in 2014, Stora Enso joined as a partner in 2019 to shore up the technology. Last year, a 350-kg/hr demo plant was started. The next step is to prove the technology at an industrial scale and then “conquer the world”, said Ylä-Jarkko.

The technology uses dissolving pulp as the raw material but the company is doing research on other possible sources. A cold alkaline solution is the key to the process. It has a low water, energy and chemical demand. The end product can replace both cotton and viscose.

By 2025, it is estimated that wood fiber could represent 7% of textile fiber production.

One of the first meetings the editors had was with Finnish Forest Industries CEO Paula Lehtomäki. She said most markets had declined dramatically in the past year leading to a drop in production. However, there have been recent signs of a pick-up.

She also said that the industry was still coming to terms with a large number of industry-related regulations. “We’re still trying to see what their impact will be and how they will affect access to raw material.”

The industry sees any “green transition” as a positive, adding that the industry now feels its concerns are getting listened to in Brussels.

This meeting was followed by a series of discussions with suppliers over the next few days.

SUPPLIERS HAVE THEIR SAY

ABB: Digital solutions was an area highlighted by Guillaume Carnaille, general manager, Europe, digital. He said that strong action is imperative for every energy-intensive industry to engage ESG measures. Many opportunities – cost savings, yield maximization, emission reduction – remain untapped. ABB has developed integrated digital operations built around various pillars including sustainability, process performance, asset performance, operations excellence and a connected workforce. All come with embedded cyber security best practices.

ABB Speakers from left to right:

Esa Kivioja, Industry Segment Manager for Pulp & Paper in Finland, ABB Process Industries

Uwe Beekhuis, Global Product Manager – QMS Frames & Sensors, ABB Process Industries

Juha Välimaa, Sales Director – Digital, ABB Process Industries

Guillaume Carnaille, General Manager Europe – Digital, ABB Process Industries

Focusing on the sustainability pillar, Carnaille said it includes monitoring and reporting, forecasting and planning as well as energy optimization. In one case, a client did an energy audit. Opting for an Energy Management System from ABB, savings totalled 289,000 euros per year. Electricity savings were about 10% and natural savings were about 8%.

Turning to quality control, the demand on quality control systems (QCS) is greater than ever. ABB Real Progress makes it possible for mills to increase production and improve quality while reducing energy needs. One case showed that a 1% improvement in moisture profile equated to 400,000 euros/yr in energy savings.

With ABB HPIR sensors, operators can identify abnormal profile areas easily and see immediate results from their corrections. They are designed for all grades, from tissue to board.

AFT: A leader in stock prep and wet end technology, its focus is on energy savings, reduced maintenance, improved formation and fast grade changes. Its latest technology is Diamond Wire®, a wear-resistant treatment designed to extend cylinder life. Kimmo Nurminen, senior product manager, screening, said it is a hexavalent chromium-free treatment that is corrosion- and impact-resistant and offers superior wear control.

Chromium is used extensively but can have environmental and health effects, so Nurminen stressed that chromium-free is an important development. He added that regulations limiting chromium use are possible.

The focus is on the company’s WedgeWire screens now but AFT hopes to make it the standard for its entire product line.

Risto Weckroth, vice president, spoke about the company’s remote specialist service, AFTLinx. Sensors mounted on AFT equipment are linked to AFTLinx. The service helps clients analyze equipment operation data. There have been about 15 deliveries thus far. It started with AFT refiners but is expanding to other product lines.

Weckroth said AFT is working to be known as a full approach flow and stock prep and refining supplier, not just as a component manufacturer. Recent sales include full systems to Stora Enso in Poland, Billerud Gruvon and Klabin’s liquid packaging machine in Brazil.

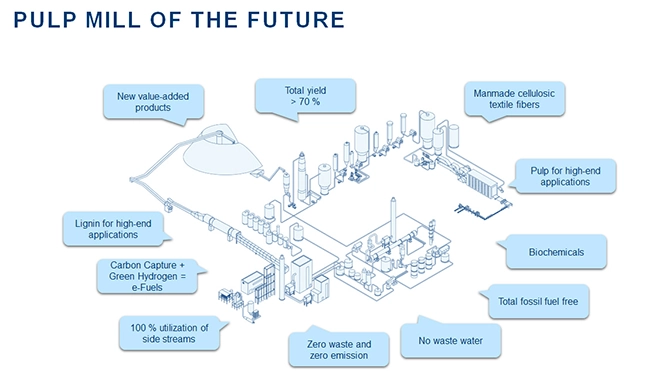

ANDRITZ: What will the mill of the future look like? By 2040, Andritz’s Johan Engstrőm posed the possibility of a chemical pulp mill increasing yield to about 70% from the traditional 50-55%. It is important to realize that it does not mean this increase will all come from more pulp production but by new products, 100% use of side streams, improved process technology, eliminating fossil fuels and the production of biochemicals.

Johan EngstrőmHe added that increasing process yield is possible. For example, not all pulp needs to be bleached to high brightness so in the end, more of the wood is used A combination of mechanical and chemical processing is also feasible.

Johan EngstrőmHe added that increasing process yield is possible. For example, not all pulp needs to be bleached to high brightness so in the end, more of the wood is used A combination of mechanical and chemical processing is also feasible.

Mills can extract, not burn lignin and/or methanol, paving the way to new value-added products. Carbon capture couple with green hydrogen can lead to the production of e-fuels, for example, aviation fuel.

A zero waste, zero emission mill with no waste water will also help increase yield. It is not a huge leap, Engstrőm said. “The technology is there. Any mill can do it in small steps. You do not need to do it all at once.”

Another benefit would be a reduction in transport-related emissions. In the future, he said, it may not be a choice as regulations take over.

These principles were also touched upon during the conference in a paper on how closed mills can become by Tommi Voutilainen, executive vp, pulp & power. He cited an example of a 3,600-t/d pulp mill using the Andritz CircleToZero program. Developments have led to reduced use of chemicals and up to 50% less water used.

In other news, Andritz has announced a collaboration with Microsoft to work towards the development of fully autonomous factories, using a data ecosystem based on the Andritz Metris digital platform and Microsoft Cloud for Manufacturing.

Erich KollmarBellmer: Erich Kollmar, CEO, told the assembled editors that after 10 years of good markets and “forward thinking”, the industry has turned “shortsighted” lately., with no real investment. However, he noted that the path of “deplastification” continues apace. “We need to stress the bioindustry. We also need to have create better packaging that is show-through or else plastics will still have the advantage.”

Erich KollmarBellmer: Erich Kollmar, CEO, told the assembled editors that after 10 years of good markets and “forward thinking”, the industry has turned “shortsighted” lately., with no real investment. However, he noted that the path of “deplastification” continues apace. “We need to stress the bioindustry. We also need to have create better packaging that is show-through or else plastics will still have the advantage.”

The German-based company has made a push into the US and recently celebrated the startup of a glass fiber tissue line at an Ahlstrom mill in Kentucky. Bellmer was one of the main suppliers of the production line including headbox, forming wire and binding sections

Valmet: Automation and flow control were Valmet’s main points of emphasis. Harri Mustonen, director, pulp & paper control systems, introduced the Valmet DNAe, its 4th generation distributed control system (DCS) since it entered the sector in 1979.

DNAe is designed to face the many challenges the modern DCS faces: reliability, data as an asset, cyber security, interoperability, labor and skill shortages adaptation to change. Mustonen said DNAe is compatible with older Valmet systems. It was designed to be easy to use for visualization and analysis. The system architecture is built to deliver maximum reliability and performance. It offers on-site or Cloud solutions depending upon customer choice. Remote operation is possible “It’s what the new age workforce wants and needs,” Mustonen said. There are about a half dozen projects underway.

Toni Kotiranta discussed innovations in flow control. This division (formerly Neles) has been part of Valmet for two years. Products include control valves, ball valves, intelligent safety valves, pumps, valve controllers, actuators as well as spare parts and services. Kotiranta noted that 75% of the world’s pulp passes through its valves. It is the No. 1 supplier in the pulp and paper industry. Europe is its biggest market, just ahead of North America. Annual revenue is more than 775 million euros and the pulp and paper industry accounts for 28% of that.

Moving forward, Kotiranta says drivers for the business are threefold: resource and raw material efficiency; reduced energy consumption and CO2 emissions; reduced risk of failure, leakage and fugitive emissions.

Virpi Puhakka, director, ecosystem R&D, explained Valmet’s ambitious Beyond Circularity program, its biggest R&D investment to date, 40 million euros along with another 70 million from other partners. The four year program began in 2022 but there is a good chance it will be extended beyond 2025. Thus far, 28 joint projects have been funded involving 230 partners. Approximately 400 Valmet employees across all business lines are working on the various projects.

There are seven streams in the Beyond Circularity program. These include: recycling technologies; biorefineries, resource efficient industries, service lifestyle concepts and emerging new process concepts and disruptive business.

Among the specific projects cited by Puhakka were: Pesco-Up, which aims to transform the textile recycling industry by creating new raw materials from mixed wastes; Power Beyond, which is looking at process optimization with friction- and vibration-less technologies for energy efficiency and circularity; and, Emission Free Pulping, which looks to significantly reduce biomass burning and increase the product yield of pulp wood.

Runtech: The company has made quite a mark in the industry with its turbo blowers. It recently enjoyed its first North American greenfield startup in a Canadian tissue mill. Jussi Lahtinen said that Europe is still the company’s main market although business is definitely picking up in North America, particularly the US, with six recent retrofit installations covering grades from tissue to board.

He noted that Runtech’s turbo pumping systems that replace liquid ring seal installations can results in energy savings of 40 to 60%.

Maglev bearings are a new development for the company’s 600-kW and 1-MW RunEco blowers. They are active magnetic bearings that replace ceramic ball bearings. Virtually maintenance-free, they compensate for any loss of balance, thus helping to eliminate vibration. The first installation was in Turkey almost two years ago and performance has been excellent.

BEYOND THE SUPPLIERS

Suzano/Spinnova/Woodspin: As seen in the conference presentations, wood cellulose-based textile fiber has serious growth potential. Woodspin is a 50:50 joint venture between Suzano and Spinnova, which has made its mark in the textile fiber market recently. Adidas has also become a Spinnova investor.

The new facility in Jyväskylä opened in 2023 and can produce 1,000 t/y with hopes to one day produce 1 million t/y of the Spinnova fiber.

Suzano ships its standard kraft pulp from Brazil to Finland where it is microfibrillated. The process is based on existing pulp and paper technology so it can use existing equipment. The spinning technology is the key patented point of the process. The original idea, said Juha Salmela, CTO, was to mimic a spider’s web.

As well as clothing, Spinnova has found a new market in composites, e.g., ski cores replacing wood and glass fiber. The same process is used to make the composite material.

As well as pulp, Spinnova can also work with leather and textile waste. For example, it has made shoes using a wool combination as well as leather waste.

With a feel like cotton, the fiber is 100% recyclable. The process generates no waste water or emissions.

VTT: The organization is one of the leading applied research bodies in Europe. It has had a long association with the pulp and paper industry. Recently, it helped Stora Enso develop a wood fiber-based barrier coating for packaging using nanocellulose.

Other industry related projects include new uses for wood-based fiber: packaging and cushioning; lightweight moldable board; plastic replacement; sound insulation; non-wovens; construction materials.

Its Jyväskylä facility includes two pilot machines. One is traditional and can run with wet laid or foam forming (fibers and other furnish components are mixed with foam instead of water). The other can run with porous media or nanocellulose film. A third machine (air laid) will start up in 2025. VTT is active in the study of waterless papermaking.

A new three-year project, Energy 1st Fiber Product Forming, kicked off in 2024. It has a budget of 6.6 million euros and has 41 partners including UPM, Kimberly-Clark, Domtar, Arauco, Voith, Andritz and Valmet.

One of the start-up companies that VTT nurtured is Aisti. It has developed novel technology to create lightweight board from natural and recyclable materials. Its Teno acoustic tiles are made from wood-based fiber and contain no plastics, mineral fibers or synthetic binders. Thus, its product answers both health and environmental questions.

COO Antti Fredrikson said that by 2050, there will be 63 billion m2 of suspended ceilings needed in new building in Europe. Aisti plans to focus on the non-residential sector. The patented process uses foam forming technology. It has built its own pilot plant and is seeking the final funding needed to build a commercial-scale facility.

The company won the Pulp and Beyond 2024 Startup Competition for its Teno acoustic tile.

Graeme Rodden has covered the pulp and paper industry for more than 40 years, including serving as editor of several well-known paper industry magazines.